Contact a Counselor | Call A Counselor Now: 844-335-3173 | Read Our Reviews | IRS Tax Debt Only Call 844-265-4933

Credit counseling for Hartford CT Residents

When you’re in serious debt in Hartford, it might seem like there’s absolutely nothing that you can do. It might feel like you’re gazing straight down at an impossible abyss. Yet this really isn’t the case. In reality, there are plenty of things you can do in order to find your path back again. This includes even though you have way over $10,000 in financial debt.

When you’re in serious debt in Hartford, it might seem like there’s absolutely nothing that you can do. It might feel like you’re gazing straight down at an impossible abyss. Yet this really isn’t the case. In reality, there are plenty of things you can do in order to find your path back again. This includes even though you have way over $10,000 in financial debt.

In reality, a lot of credit counseling services work well particularly if you have this much financial debt.

Credit Advice Overview for Hartford Residents

Among the first actions on your route to monetary solvency is to get some credit counseling assistance or perhaps debt counseling in Hartford. This is also oftentimes known as consumer credit counseling. There are a number of various organizations which can help you with this depending on your area. For example, the Federal Trade Commission is one of the governing organizations which regulate debt counseling companies. This is to ensure they are more secure for clients.

Among the first actions on your route to monetary solvency is to get some credit counseling assistance or perhaps debt counseling in Hartford. This is also oftentimes known as consumer credit counseling. There are a number of various organizations which can help you with this depending on your area. For example, the Federal Trade Commission is one of the governing organizations which regulate debt counseling companies. This is to ensure they are more secure for clients.

The appropriate agencies are totally secure, and U.S. governing agencies such as FTC among others help keep this the scenario. The essential concept behind credit counseling is that a firm serves as a go-between that works with a person and their creditors to make a mutually beneficial scenario for everyone. After all, when you’re in financial trouble and have difficulty getting out of it, your falling more and more isn’t able to benefit anybody.

Ways Firms Assist You in Hartford

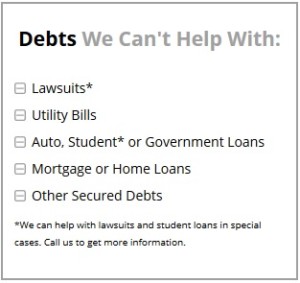

Quite a few credit counseling agencies charge somewhat small service fees, or perhaps charges determined by your level of success with reducing your debt. Some choices you’ve got include filing for bankruptcy under Chapter 13 if you reside in America. In this case, you’re essentially needed to acquire guidance, thus a counseling firm can certainly guide you through it.

The point is, you’re never so deep in debt that you don’t have solutions. There will always be solutions that you could take when you have a guide seasoned enough with bankruptcy and debt law for your specific country to assist you to discover exactly how to begin digging yourself out.

What Your Creditors Can Acquire in Hartford

Of course, credit cards along with other corporations that you owe money to can do a lot of nasty things to have that money back, yet a lot of these activities cost some money to do. Your creditors would like to get their funds back, not expend considerably more money. This is proceeding in the wrong path. So, by going with an agency, you are actually assisting creditors as well because firms could help make it less difficult for you to pay back your debts.

Anything that can make it more likely that they’re going to get their money is something that many of your lenders are going to be favoring. It may look like they are merely in it to annoy you, but they’re merely interested in profits and present to them the potential of recovering money and they’ll usually end up being on board.

Preventing Bankruptcy and Ending Telephone Calls in Hartford

Lots of agencies could likewise help you avoid bankruptcy entirely, if it is your goal. These agencies can occasionally assist in lowering unwanted calls that you get on the phone as well. After all, these calls could increase your anxiety and make it tough for you to think correctly and discover your path out of your dilemmas.

Lots of agencies could likewise help you avoid bankruptcy entirely, if it is your goal. These agencies can occasionally assist in lowering unwanted calls that you get on the phone as well. After all, these calls could increase your anxiety and make it tough for you to think correctly and discover your path out of your dilemmas.

Agencies can interface directly between you and your lenders to eliminate almost all types of harassment in some cases. Even something as simple as this typically has a surprisingly good influence on your mood, you’ll discover.

Other Ways counseling Services Can Help in Hartford

Sometimes, counseling services might be able to aid you to boosting your credit rating. They can sometimes assist with eradicating or lessening late payment fees as well as other charges. They could help work together with you and your lenders to discover a payment plan that works for all parties so you’re not merely giving up as it looks totally pointless to go on.

Credit Counseling services can really help bring back peace of mind to your life again in a surprising number of scenarios. Quite a few likewise have extensive privacy policies to make sure the status of your financial situation doesn’t get out in methods that you don’t want.

All of this is to point out that everything isn’t lost by far. If you have not less than $10,000 in financial debt, your initial step starts off with filling out the application or making a call 855-977-9032. The earlier you get started out, the quicker you will get back on the road to even credit. Send in the form or call, and you’ll be amazed how much better you feel about yourself. The initial step to switching everything around is often the hardest, after all. Get over the initial step of making a call, and you may just about be halfway there emotionally.

Through the exact same token, you may also be going a long way to saving some cash over your other options as well in Hartford.