Contact a Counselor | Call A Counselor Now: 844-335-3173 | Read Our Reviews | IRS Tax Debt Only Call 844-265-4933

Credit Counseling for Pawtucket RI Residents

Consumer Credit Counseling in Pawtucket

When you’re in serious financial debt, it may feel like there’s practically nothing that you can do. It may feel like you’re gazing straight down at an impossible abyss in Pawtucket. But this really isn’t the situation. In fact, there are lots of things you can do in order to find your way back up again. This includes even though you have way over $10,000 in financial debt.

When you’re in serious financial debt, it may feel like there’s practically nothing that you can do. It may feel like you’re gazing straight down at an impossible abyss in Pawtucket. But this really isn’t the situation. In fact, there are lots of things you can do in order to find your way back up again. This includes even though you have way over $10,000 in financial debt.

In fact, a lot of credit counseling services actually work particularly when you have this much debt.

Credit Advice Introduction for Pawtucket

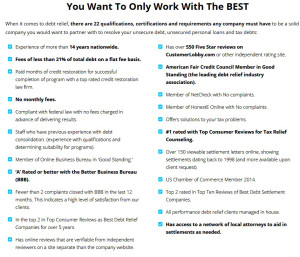

One of the initial steps on your way to monetary solvency is to obtain some credit guidance help or even financial debt counseling. This is also often known as consumer credit counseling. There are a lot of different businesses that could aid you with this based on your location. For instance, the Federal Trade Commission is one of the governing organizations which manage debt counseling agencies. This is to make them much safer for people.

One of the initial steps on your way to monetary solvency is to obtain some credit guidance help or even financial debt counseling. This is also often known as consumer credit counseling. There are a lot of different businesses that could aid you with this based on your location. For instance, the Federal Trade Commission is one of the governing organizations which manage debt counseling agencies. This is to make them much safer for people.

The best agencies are completely secure, and U.S. regulating agencies like the FTC and others help keep this the scenario. The essential concept driving consumer credit counseling is a firm functions as a go-between that works with a consumer as well as their creditors to create a mutually favorable scenario for everybody. In the end, when you’re in financial trouble and have difficulties stepping out of it, your falling more and more isn’t able to benefit anybody.

How Agencies Aid You in Pawtucket

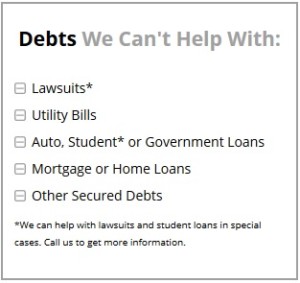

Various consumer credit counseling agencies ask for rather small service fees, or perhaps charges determined by your degree of success with cutting down on your financial debt. A number of choices you have include filing for bankruptcy under Chapter 13 if you reside in the United States. In this situation, you’re actually required to acquire counseling, so a counseling agency can certainly guide you through it.

The idea is, you’re never very deep with debt that you don’t have alternatives. There will always be approaches that you could take on when you have a guide seasoned enough with bankruptcy and debt law for your specific country to assist you to see exactly how to begin digging yourself out.

The idea is, you’re never very deep with debt that you don’t have alternatives. There will always be approaches that you could take on when you have a guide seasoned enough with bankruptcy and debt law for your specific country to assist you to see exactly how to begin digging yourself out.

The Things Your Loan Providers Can Obtain for Pawtucket

Sure, credit cards as well as other corporations which you owe money to can do a lot of horrible things to have that money back, but most of these things cost some money to complete. Creditors would like to get their funds back, not invest considerably more money. This really is proceeding in the wrong track. Thus, by going with a firm, you’re basically helping your creditors as well because agencies can help make it easier for you to settle the money you owe.

Something that makes it more probable that they’re going to be given their money is something that a majority of your lenders are going to be in favor of. It may seem as if they are merely in it to bother you, but they are merely thinking about earnings and display to them the possibility of recovering profits and they will frequently end up being on board.

Weigh all options before Bankruptcy and Stopping Phone Calls for Pawtucket

Lots of agencies can likewise help you stay away from bankruptcy altogether, if it’s your aim. These firms can sometimes assist in reducing harassing phone calls that you get on the telephone too. After all, these telephone calls can easily build up your stress and make it hard for you to think straight and discover your path away from your problems.

Agencies can interact directly between you and your lenders to eradicate almost all forms of harassment in some cases. Even a simple thing like this frequently has a remarkably positive effect on your state of mind, you’ll discover.

Other Ways counseling Services Could Help in Pawtucket

Sometimes, counseling services can aid you to boosting your credit rating. They can in some cases assist with eradicating or lessening late fees and other penalties. They could help work together with you and your lenders to identify a payment plan that works for all parties so you’re not merely giving up as it appears totally pointless to continue.

Consumer Credit Counseling services really can help bring back sanity to your life again in a surprising number of cases. Quite a few also have thorough privacy policies to be sure the status of your financial situation doesn’t leak out in ways that you don’t like.

All of this is to say that everything isn’t lost by far. When you have at least $10,000 in financial debt, your first action begins with completing the application or making a telephone call to 866-951-4314. The sooner you get started out, the quicker you will get back on the road to even credit. Submit the form or simply call, and you will be astonished how much better you will feel about yourself. The initial step to switching everything around is usually the most challenging, after all. Pass though step one of making a phone call, and you might nearly be halfway there on an emotional level.

And by exactly the same token, you will also be going a long way to cutting down some money over your other options as well in Pawtucket.