Contact a Counselor | Call A Counselor Now: 844-335-3173 | Read Our Reviews | IRS Tax Debt Only Call 844-265-4933

Credit Counseling for Portsmouth RI Residents

Consumer Credit Counseling Services for Portsmouth

If you’re in serious debts, it may feel like there’s nothing you can do. It may seem like you’re staring down at an impossible abyss. But this really isn’t the case. In reality, there are numerous things you can do in order to find your way back up again. This includes even though you have way over $10,000 in financial debt.

If you’re in serious debts, it may feel like there’s nothing you can do. It may seem like you’re staring down at an impossible abyss. But this really isn’t the case. In reality, there are numerous things you can do in order to find your way back up again. This includes even though you have way over $10,000 in financial debt.

In fact, lots of credit counseling services work well specifically should you have that much debt.

Credit Counseling Introduction for Portsmouth

One of the first actions on your way to financial solvency is to find some credit counseling help or perhaps financial debt counseling. This is sometimes known as consumer credit counseling. There are lots of various businesses which can help you with this depending on your country. For instance, the Federal Trade Commission is one of the governing bodies that handle debt counseling agencies. This is to make them more secure for customers.

One of the first actions on your way to financial solvency is to find some credit counseling help or perhaps financial debt counseling. This is sometimes known as consumer credit counseling. There are lots of various businesses which can help you with this depending on your country. For instance, the Federal Trade Commission is one of the governing bodies that handle debt counseling agencies. This is to make them more secure for customers.

The best organizations are completely safe to use, and U.S. governing bureaus such as FTC and others help to keep this the case. The primary idea powering consumer credit counseling is that an agency functions as a go-between that works with a person and their creditors to come to a mutually favorable position for everyone. After all, whenever you’re with big debts and have difficulty getting out of it, your falling more and more isn’t able to benefit anybody.

Ways Agencies Assist You in Portsmouth

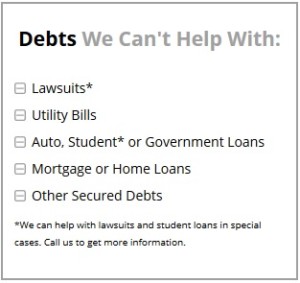

Some consumer credit counseling firms demand rather modest service fees, or perhaps fees determined by your degree of success with decreasing your financial debt. A number of choices you have include declaring bankruptcy under Chapter 13 if you live in America. In this situation, you’re essentially needed to get guidance, so a counseling agency could certainly lead you through it.

The thing is, you’re never so deep with debt that you don’t have solutions in Portsmouth. There are always strategies that you could take on when you have a guide skilled enough when it comes to bankruptcy and debt legislation for your particular location to help you discover how to begin digging yourself out.

The thing is, you’re never so deep with debt that you don’t have solutions in Portsmouth. There are always strategies that you could take on when you have a guide skilled enough when it comes to bankruptcy and debt legislation for your particular location to help you discover how to begin digging yourself out.

The Things Your Creditors Can Obtain in Portsmouth

For sure, credit cards along with other organizations which you owe money to can do all sorts of awful things to get that money back, but lots of these activities cost some money to complete. Creditors would like to get their funds back, not shell out considerably more money. This really is heading in the wrong direction. Hence, by going with a firm, you’re really helping creditors as well since firms can help make it simpler for you to pay back your debt.

Something that can make it more probable that they’ll receive their cash is a thing that a lot of your creditors will be in favor of. It may look like they are just in it to bother you, but they’re merely thinking about profits and present to them the potential of recouping earnings and they will in most cases be on board.

Evaluate all options before Bankruptcy and Stopping Calls for Portsmouth

Lots of firms can also help you steer clear of bankruptcy altogether, if it is your aim. These firms can occasionally assist in reducing annoying phone calls that you get on the mobile phone too. After all, these telephone calls could increase your anxiety and make it tough for you to think correctly and find your path away from your dilemmas.

Agencies can easily interact directly between you and your lenders to eliminate almost all kinds of harassment in some instances. Even something as simple as this often has a surprisingly favorable effect on your disposition, you’ll discover.

Other Ways and Means counseling Services Can Help for Portsmouth

Sometimes, counseling services can aid you to boosting your credit score. They can at times assist with wiping out or reducing late fees along with other fines. They could help work together with you and your creditors to identify a payment plan that actually works for all sides so you’re not merely quitting as it seems completely useless to go on.

Counseling services can really help bring back peace of mind to your daily life again in a striking number of cases. Many likewise have extensive privacy regulations to ensure the state of your finances doesn’t leak out in ways that you don’t like.

All of this is to declare that everything isn’t lost by far. In case you have not less than $10,000 in debt, your initial action begins with filling out the form or making a phone call 866-951-4314. The faster you get started, the quicker you could get back on the way to even credit. Send in the form or simply call, and you will be astonished how much better you will feel about yourself. The initial step to switching everything around is often the toughest, after all. Pass though the first step of making a telephone call, and you may nearly be halfway there on an emotional level.

Through the exact same token, you’ll also be going quite a distance to keeping some money more than your other options as well Portsmouth.