Contact a Counselor | Call A Counselor Now: 844-335-3173 | Read Our Reviews | IRS Tax Debt Only Call 844-265-4933

Credit Counseling for Montgomery AL Residents

Credit Guidance for Montgomery

Here in our debt community, the total amount that you’re underwater can be really discouraging. However, it’s entirely true that it doesn’t need to be. There are things you can do. An individual always has options. This is very important to be aware of. A good example of options that you have is consumer credit counseling solutions. Here’s information about what you could do to better your position should you have a lot of debt, including credit card debt.

Here in our debt community, the total amount that you’re underwater can be really discouraging. However, it’s entirely true that it doesn’t need to be. There are things you can do. An individual always has options. This is very important to be aware of. A good example of options that you have is consumer credit counseling solutions. Here’s information about what you could do to better your position should you have a lot of debt, including credit card debt.

Above $10K in Debt in Montgomery

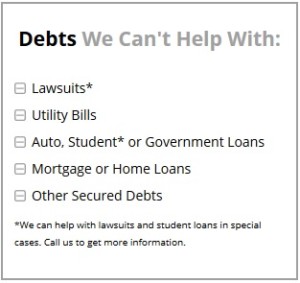

The first thing to consider is precisely the amount of debt you’ve got.You need to have more than $10k in debt to be eligible for credit counseling, or perhaps the kind of services we are going to discuss here. In case you have a lot less than that, you have a lot of other choices and excavating yourself out might not be really hard.

If you have greater than $10k in debt, especially if it’s far more than 10K, it’s obviously very easy to get overwhelmed. Yet consumer credit counseling solutions are absolutely available on the market. The trick is just to find them. As soon as you do, this can oftentimes end up being the most difficult part. From that point, you’ll get assistance. The hardest step is usually whenever you’re seated there; gazing at all of the debt, and feeling baffled about how you are able to create a dent in it all and get your whole life back again.

Ending Calls for Montgomery

One of the very first actions that credit counseling assistance can do is end harassing calls. You might laugh them off, pay no attention to them, tell yourself that they don’t worry you, but the truth is they most likely do. Even though you don’t know it, all of the calls on a regular basis can be tiring you out, particularly when added on to all of your other monetary problems. There’s a reason why organizations utilize them. Lots of people will simply pay more money compared to what they can afford to credit collection agencies in order to make the infinite phone calls end.

But a fantastic counselor can put the clamp down on this issue quickly when you get moving with them. You’d be surprised just how much this could boost your perspective. You’re already performing far better, even with just a very simple transformation that makes you feel as if you have your freedom of privacy back again.

But a fantastic counselor can put the clamp down on this issue quickly when you get moving with them. You’d be surprised just how much this could boost your perspective. You’re already performing far better, even with just a very simple transformation that makes you feel as if you have your freedom of privacy back again.

Lender Go-between in Montgomery

One of the more significant things that a counselor is able to do for you is function as a go-between when it comes to both you and your creditors. It might seem like the only aim of your lenders about half of the time is to wreak havoc on you, yet this really isn’t the truth. They want their money back, and whatever gives them more money in contrast to what would happen anyway would be a great thing.

After all, they don’t want to pass through expensive court proceedings any more than you do. That’s making them throw money away, not have it back. They’d likewise rather that this be merely a final option sort of thing if there’s lots of money on the line. A good counselor could help remind your lenders of this, and negotiate a much better deal for all sides. You’ll have a better chance of being put on a repayment plan which you really have a prayer of paying back, which could place you closer to where you wish to be in terms of financial solvency. Needless to say, the precise amount of money you can save by making use of a counselor will vary greatly depending upon the counselor and based on your unique situation, but the idea is that it will most likely be a greater savings than what you would get otherwise.

Professional Guidance for Montgomery

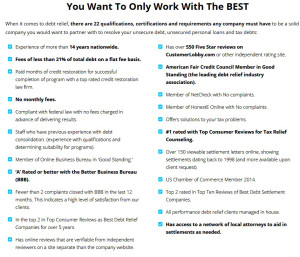

The vital thing to bear in mind is that you’ve probably never experienced the whole process of undoing a substantial amount of debt in the past. Your counselor has. If you get an outstanding company to work alongside, they’ve seen every little thing there is to discover when it comes to debt issues. They are able to direct you in a way that you certainly couldn’t handle by yourself due to a lack of experience. You really want to settle for those who have researched and specialized in this stuff, simply because the guidelines could be intricate and it is your financial future we’re talking about.

Taking Your Life Back in Montgomery

All of that is to point out, that the first step is actually calling a counselor, or perhaps making a few calls to get this moving. You could fill out the form or perhaps make the telephone call lying just before you right now, and this can be the greatest barrier to acquiring the aid you need to have your life back again in a manner that makes you feel sane once again.

But you should make the call first. Submit the form or make that telephone call today to 866-951-4314. Go ahead and take initial step. You’ll feel a whole lot better that way.